accumulated earnings tax c corporation

The AET is imposed in addition to the regular corporate income tax. This is because corporations that do not spend retained earnings are generally more valuable than those without accumulated retained earnings.

Is Corporate Income Double Taxed Tax Policy Center

Ad Discover Why We Have Been Chosen for Business Incorporation for 40 Years.

. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. Publication 542 012019 Corporations - IRS tax forms. Receive Personal Attention From a Knowledgeable Business Incorporation Expert.

The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a business through a C corporation to take advantage of the low 21 federal corporate income tax rate retain earnings in the corporation by minimizing compensation and dividends. The characterization of the distribution is governed by Section 1368 c.

Itself is liable for federal corporate income tax at rates up to 35 percent and files IRS Form 1120. Ad Bank Account included with our 199 LLC formation. Tax Rate and Interest.

C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the. It also found Metro was subject to the accumulated earnings penalty tax.

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec. Atlas for the fiscal years ending June 30 1969 and. If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15.

There is no IRS form for reporting the AET. Atlas for the fiscal years ending June 30 1969 and 1970 and transferee liability of Atlas. Withholding tax at a rate of 30 percent this rate could be significantly reduced if favorable treatment is available under.

In January you use the worksheet in the Form 5452 instructions to figure your corporations current year earnings and profits for the previous year. Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. May 17th 2021.

A corporation may be allowed an accumulated earnings credit in the na-. 532 2020 Section Name 532. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes.

Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. This decreases government tax revenues because shareholders are unlikely to sell their valuable. If the distribution does not exceed the AAA the distribution is treated as if made by an S corporation with no accumulated.

IRC 1368 c 1. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. Although dividends paid out of current or accumulated earnings and profits to a foreign shareholder are subject to US.

If imposed the earnings are subject to triple taxation when eventually. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend. Form your Wyoming LLC with simplicity privacy low fees asset protection.

Get the tax answers you need. At the beginning of the year the corporations accumulated earnings and profits balance was 20000. Accumulated earnings and profits are a companys net profits after paying dividends to.

A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax. In periods where corporate tax rates were significantly lower than individual tax rates an obvious. Ad Find out what tax credits you might qualify for and other tax savings opportunities.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. The IRS audited Metros return and after modifying the companys deductions for officers salaries determined it had not paid enough tax. This case presents cross-appeals from decisions of the United States Tax Court upholding in consolidated cases a deficiency in federal income tax asserted for the taxable year 1970 against Stephan and Mildred Schaffan a deficiency in accumulated earnings tax against Atlas Tool Co Inc.

The risk of incurring such tax is usually associated with the closely-held company but there is per. If a C corporation retains earnings above a certain amount the corporation may be assessed a tax penalty called the accumulated. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20. Traded stock IRC section 532c. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000.

This case presents cross-appeals from decisions of the United States Tax Court upholding in consolidated cases a deficiency in federal income tax asserted for the taxable year 1970 against Stephan and Mildred Schaffan a deficiency in accumulated earnings tax against Atlas Tool Co Inc. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out. If the accumulated earnings tax applies interest applies.

Talk to a 1-800Accountant Small Business Tax expert. Metro Leasing and Development Corp. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to avoid paying taxes by not paying dividends.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA. PHC Tax Calculation 5-11 Accumulated Earnings Tax 5-12 Corporations Subject to the Penalty Tax 5-12 Proving a Tax-Avoidance Purpose 5-13 Evidence Concerning the Reasonableness of an Earnings Accumulation 5-14 Calculating the Accumulated Earnings Tax 5-18 Comprehensive Example 5-21 Tax Planning Considerations 5-22 Avoiding the Personal Holding.

Corporations subject to accumulated earnings tax. Section Text a General rule.

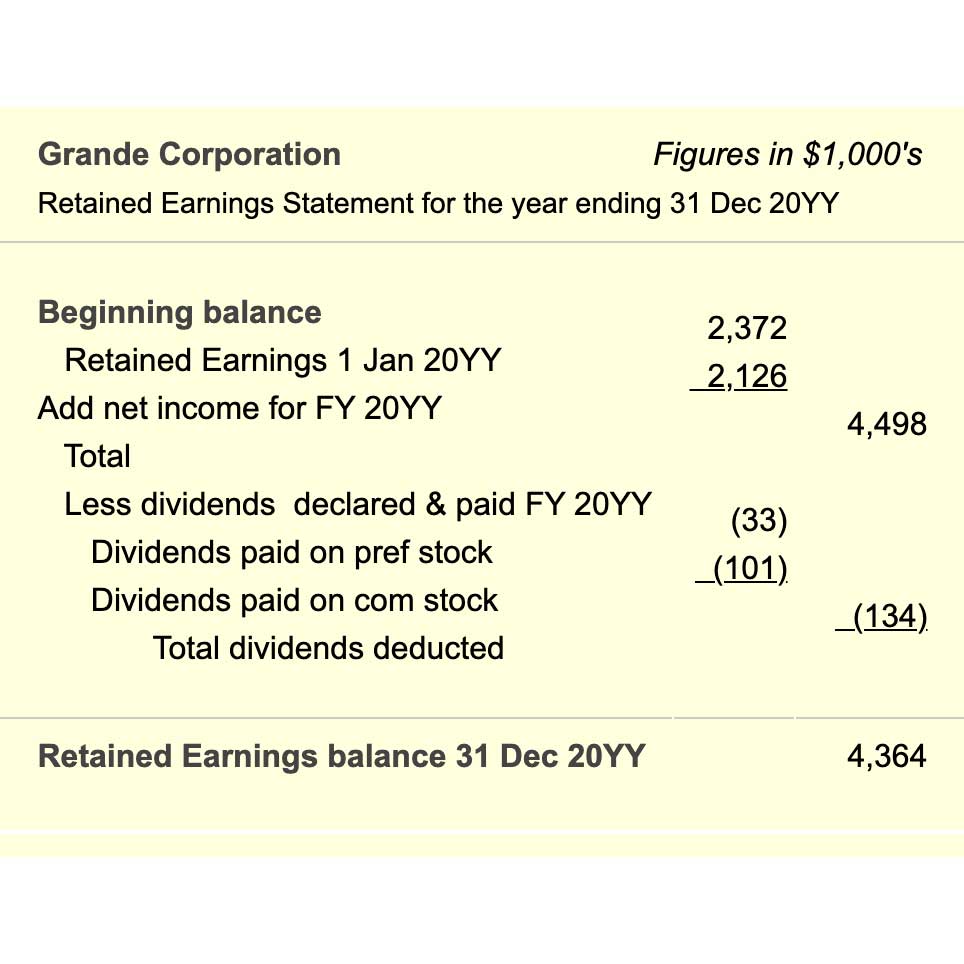

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Income Tax Computation For Corporate Taxpayers Prepared By

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Earnings And Profits Computation Case Study

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

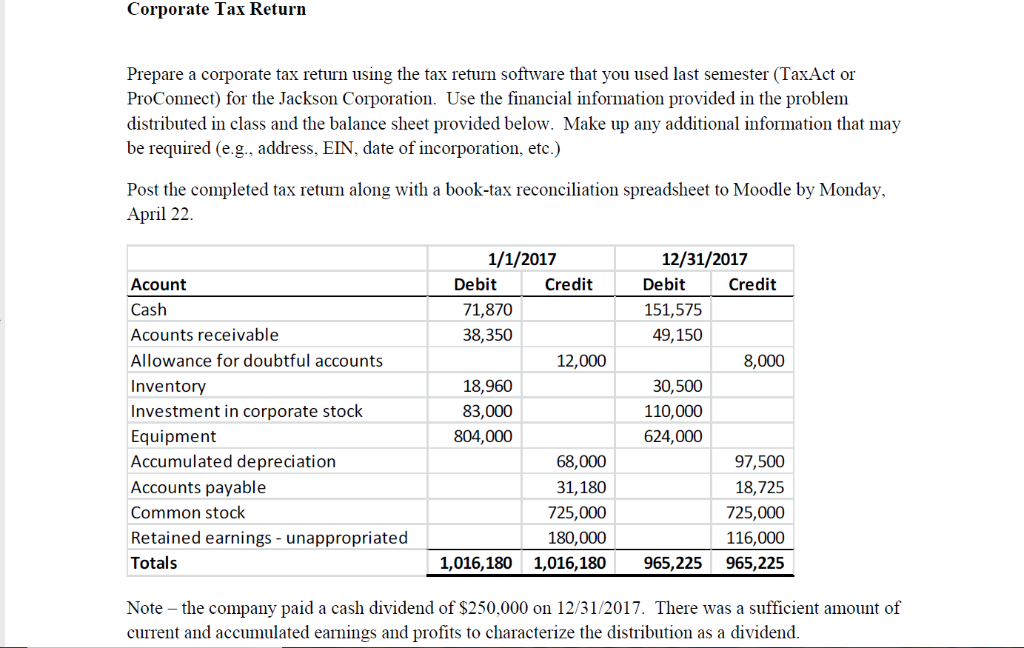

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

Income Tax Computation For Corporate Taxpayers Prepared By

What Are Accumulated Earnings Definition Meaning Example

Oh How The Tables May Turn C To S Conversion Considerations Stout

Demystifying Irc Section 965 Math The Cpa Journal

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Is Corporate Income Double Taxed Tax Policy Center

How Directors Use Shareholder Dividends To Build Owner Value

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download